Sales Tax Calculator 2025 Az - Arizona Sales Tax Guide SalesTaxSolutions.US, Arizona sales and use tax rates in 2025 range from 5.6% to 11.2% depending on location. Finance Archives CalculatorSeat, The state general sales tax rate of arizona is 5.6%.

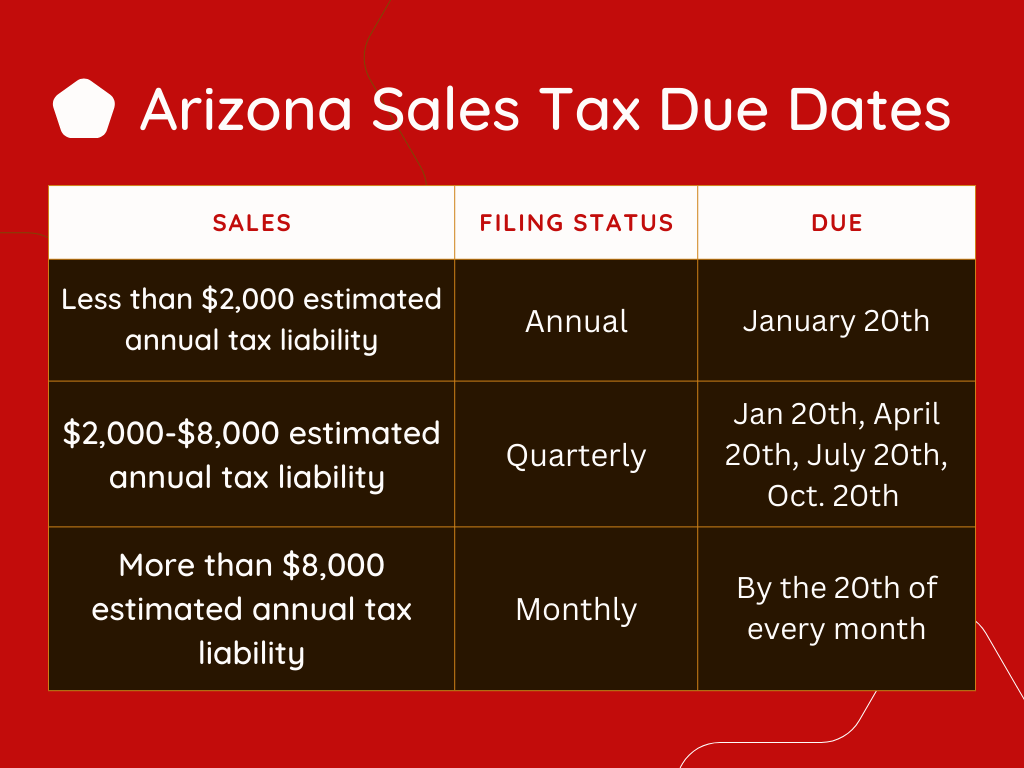

Arizona Sales Tax Guide SalesTaxSolutions.US, Arizona sales and use tax rates in 2025 range from 5.6% to 11.2% depending on location.

Sales Tax Calculator 2025 Az. Employees in arizona to calculate their annual salary after tax. The total sales tax rate in tucson comprises the arizona state tax, and the sales tax for mipa county.

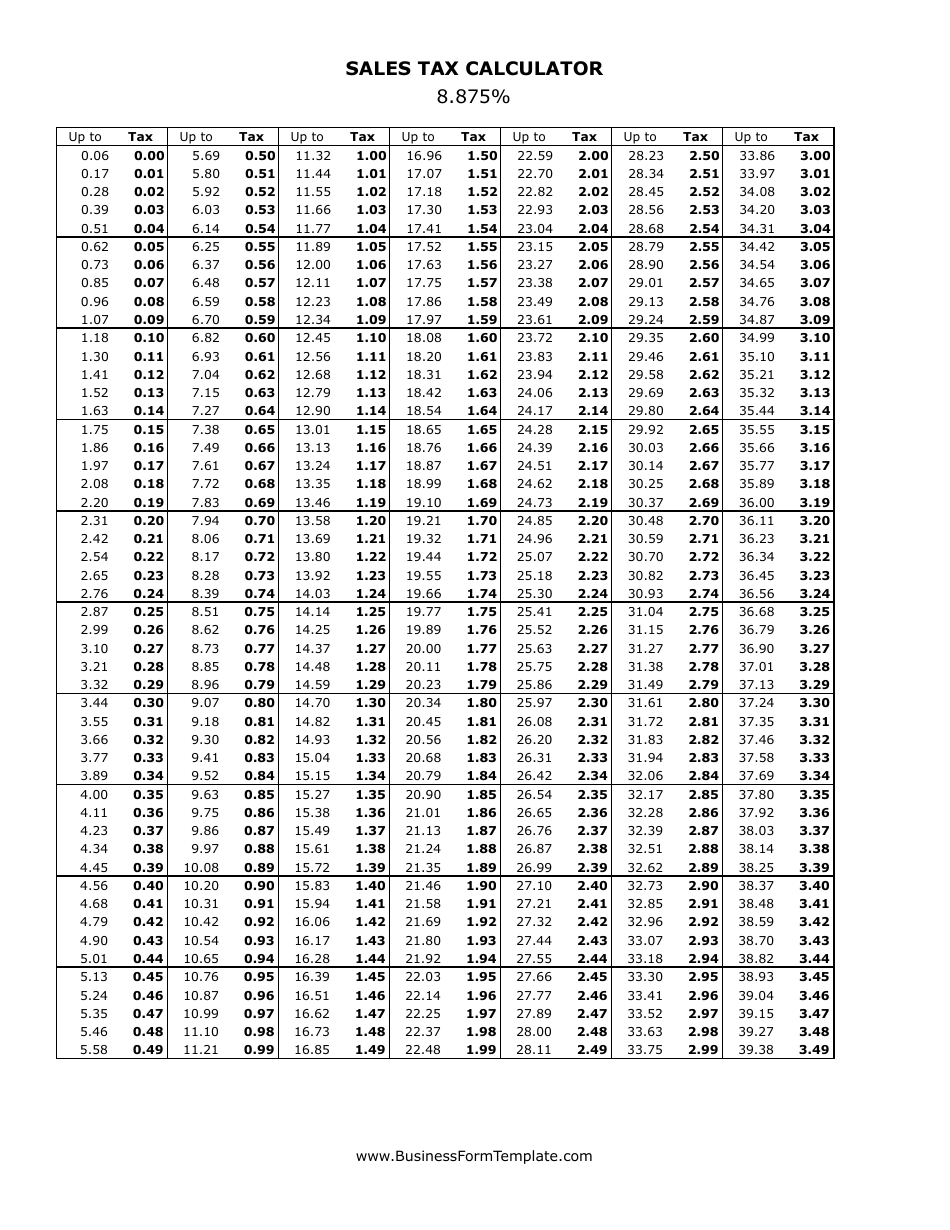

8.875 Sales Tax Calculator Fill Out, Sign Online and Download PDF, Sales tax and reverse sales tax calculator arizona (tax year 2025:

Sales Tax Calculator Double Entry Bookkeeping, The tempe, arizona, general sales tax rate is 5.6%.

Ky Sales Tax Chart, Sales tax and reverse sales tax calculator arizona (tax year 2025:

Tax Brackets 2025 Arizona State Cele Meggie, The city also imposes an additional sales tax of 2.60%.

For more detailed sales tax calculations including multiple items (products and/or services subject to sales. Average local + state sales tax.

Sales Tax Calculators on the App Store, Every 2025 combined rates mentioned above are the results of arizona state rate (5.6%), the county rate (0% to 1.3%), the arizona cities rate (0% to 5%), and in some case.

Tax Calculator 2025 Salary Gabbi Joannes, Lowest sales tax (5.6%) highest sales tax (11.7%) arizona sales tax:

Tax rates for the 2025 year of assessment Just One Lap, Depending on the zipcode, the sales tax rate of scottsdale may vary from 8.05% to 9.3%.

Tax Calculator FY 20252025 How to Create Tax, These figures are the sum of the rates together on the state, county, city, and special levels.